Switzerland (Head Quarters)

IDR Medical Switzerland

Austrasse 95, CH-4051 Basel, Switzerland

T:

+41 (0) 61 535 1109

UK

IDR Medical UK

Unit 104 Eagle Tower, Eagle Tower

Montpellier Drive, Cheltenham, GL50 1TA

T:

+44 (0) 1242 696 790

USA

IDR Medical North America

225 Franklin Street, 26th Floor

Boston, Massachusetts 02110, USA

T:

+1 (0) 617.275.4465

-1.jpg)

The US Home Health Landscape

Home Health Agencies (HHAs) in the USA provide medical treatment for patients who do not require hospitalisation but do need additional support to live safely at home, e.g., with a chronic condition.

The home health landscape is very different to the hospital landscape. The home health market is fragmented, with over 12,000 HHAs across the US. Whilst some national HHAs are part of an integrated delivery network (IDN), the majority are small and independent.

Moreover, HHAs are reimbursed via HHRG codes rather than CPT or DRG codes that hospitals use to bill insurance companies. The continued impact of COVID-19 and an ageing population has increased demand for at home health services.

In this month’s blog, we have applied our market expertise to explore the landscape of home health agencies in the USA, the role of HHAs, how patients are referred to them and their level of influence over brand choice.

The role of Home Health Agencies in the USA

The primary role of HHAs is to provide skilled medical care and other therapeutic services to patients at home. HHAs have policies established by a group of professionals (associated with the agency), including at least one physician and one or more nurses to govern the services it provides.

Most HHAs are also Medicare certified, and due to the nature of their work, they are heavily regulated.

Services provided by HHAs include the following:

- Medication management

- Therapy services (e.g., physical therapy)

- Specialised care for Alzheimers and Dementia

- Monitor vital signs such as blood pressure and temperature

- Monitor how the patient is responding to treatment

- Administer medication in emergencies

- Use feeding tubes and catheters when necessary

HHAs vary in size; some are large national HHAs with multiple locations across multiple states. These HHAs are likely to be part of an IDN with other sites of care (e.g., hospitals, skilled nursing facilities) also owned by their employer.

Other HHAs are much smaller and local with ~20 staff. In 2020, LexisNexis Risk Solutions published the top 100 USA Home health agencies.

How are patients referred to a Home Health Agency in the USA?

A range of healthcare sites can refer patients to an HHA. The majority of referrals come from the non-acute environment (i.e., Primary Care Physicians, office-based specialists). Hospitals are responsible for a minority of referrals.

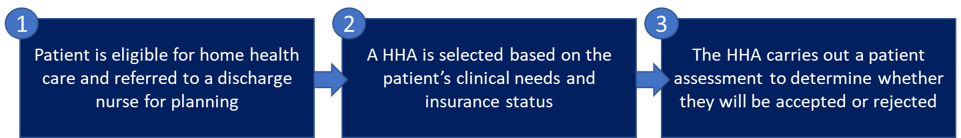

The HHA referral process is outlined below:

Stage 1 - Referral

Once the hospital has determined that the patient is eligible for home health care, the physician will refer them to the discharge planner to discuss options with the patient regarding home health agencies.

Stage 2 – Choice of HHA

In most cases, the patient gets to choose from various HHAs. Although Medicare patients must select a Medicare certified HHA (most of which are), a patient with private insurance may be required to be referred to a specific HHA.

Stage 3 - Patient assessment

Once an HHA has been selected and the patient referral is sent, the HHA carries out a patient assessment which includes: the patients’ demographics (to determine if they are in located in the HHA’s catchment area), and whether their insurance will cover the HHA's services.

The hospital must also ensure that prior to discharge a physician has been assigned to the patient (as required by Medicare).

Stage 4 - Decision

The HHA then makes the decision to either accept or reject the patient. If the patient is accepted, then they are assigned a nurse and HHRG code.

Influence of the HHA on brand choice

When it comes to ordering any treatment the patient requires, the HHA is guided by the prescription provided by the physician. The HHA nurse orders medication/products for the patient against the prescription.

Products come from the HHA’s medical supply company/DME (durable medical equipment company).

Whilst all prescriptions state the type of medicine/device e.g., intermittent catheter, they don’t all specify the brand of product required. In those cases, the HHA is free to order whatever brand is first line on their formulary.

HHAs and their medical suppliers have significant influence with regard to the brand of product the patient receives when they are at home.

If you are considering engaging with a Home Health Agency in the USA, it is important to understand which stakeholders are the most influential when it comes to getting products on the formulary:

HHA clinicians

These are, for example, specialist nurses that work for the HHA recommend products to be included on the formulary. They are involved in the decision with regard to which brands should be prioritised for use.

HHA supply chain

As previously mentioned, some national HHAs are owned by an IDN that also owns multiple sites of care. The finance/supply chain department of the IDN also influences the brand at the corporate level. They negotiate pricing and contracts with medical supply companies (based on recommendations from clinicians) and have final approval over what products are on the formulary.

Medical supply company/DME

Supply companies negotiate contracts with HHAs which ultimately determines what products end up on their formulary. The HHA’s formulary is also influenced by what the supply company stocks.

How IDR Medical can help

As the demand for home health agencies in the USA increases, understanding the landscape will become more important. As such, engaging with HHAs and medical supply companies/DMEs to encourage product uptake is crucial.

With over ten years of market expertise, IDR Medical can advise you in selecting the best markets, respondents and methodologies for your research based on your interests, products, and capabilities.

To find out more about how we can help your business, please do not hesitate to contact us. We would be delighted to offer an initial telephone discussion, or an online meeting to understand how we can assist you.