Switzerland (Head Quarters)

IDR Medical Switzerland

Austrasse 95, CH-4051 Basel, Switzerland

T:

+41 (0) 61 535 1109

UK

IDR Medical UK

Unit 104 Eagle Tower, Eagle Tower

Montpellier Drive, Cheltenham, GL50 1TA

T:

+44 (0) 1242 696 790

USA

IDR Medical North America

225 Franklin Street, 26th Floor

Boston, Massachusetts 02110, USA

T:

+1 (0) 617.275.4465

The Reimbursement Environment for Medical Devices in Spain

Background

Spain has a population of ~46.4 million citizens, divided across 17 regions.

Almost all Spanish citizens are covered by the National Health Service (Sistema Nacional de la Salud - SNS). The NHS is managed by the government and the main stakeholder is the Ministry of Health and Consumer Affairs (MSC). The funding for the NHS comes from taxation with the general government distributing funding to each region based on various criteria, such as population and demographic data.

The SNS is coordinated by the National Health System Interterritorial Council (Consejo Interterritorial del Sistema Nacional de Salud - CISNS), which contains representatives from all the regional health services and is presided by the Minister of Health.

The 17 autonomous regions of Spain are responsible for the delivery and finance of healthcare, ultimately determining their own budgets and reimbursement guidelines. On the other hand, the MSC will focus on pharmacovigilance, approvals, costs and policies on a national level.

Who are the decision makers/influencers?

The main decision makers are the Health Technology Assessments Organizations – approval from these bodies is required when new techniques, technologies or procedures are implemented. There are three different HTA levels:

- National level for common benefit package (excludes pharmaceutical)

- National level for pharmaceuticals

- Regional level

- National Health System Interterritorial Council (CISNS): contains representatives from both national and autonomous regional governments and defines the benefit package in the SNS.

- National HTA agency (Instituto de Salud Carlos III - ISCIII) coexists with several HTA organizations in the Spanish autonomous regions (Comunidades Autonomas): ISCIII is connected to the Ministry of Health and proposes/develops healthcare guidelines to support research and technological development. The ISCIII provide HTA reports to the CISNS, who is the decision maker for policies.

- There are seven autonomous HTA agencies in Spain: the functions and evaluation processes of these HTA organizations are regulated by the Autonomous Communities and not by a national standard. This leads to a lack of transparency and several inequalities across regions. Catalonia, Madrid/Valencia, Andalusia and the Basque Country are the most influential regions, where smaller regions tend to follow similar policies and processes.

- If the new technologies could significantly increase health expenditures, HTA requires the approval by the Fiscal and Financial Policy Council (Consejo de Politica Fiscal y Financiera Financial).

- The Spanish Agency for Medicines and Healthcare Products (Agencia Española de Medicamentos y Productos Sanitarios/AEMPS) is responsible for authorising and classifying new medicines. They evaluate clinical benefit, innovation and level of utility.

Reimbursement and pricing approval process

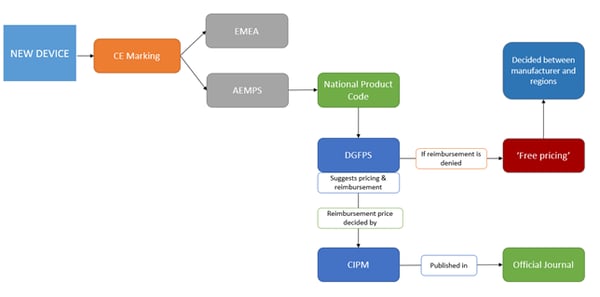

Marketing authorization is granted either by the European Medicines Agency (EMEA) or the Spanish Medicine Agency (Agencia Espanola del Medicamento y Productos Sanitarios/AEMPS). The latter evaluates the utility of the new devices and pharmaceutical products to be considered - this includes an evaluation of all technical and quality aspects of the device. As all other European countries, devices also need to have a CE marking to confirm it complies with the EU established directives.

After receiving market authorization, the manufacturer needs to get a national product code from the AEMPS. The Directorate of Pharmaceutical and Health Products (DGFPS), as part of Ministry of Health, can then initiate procedures to suggest pricing and reimbursement. These will be ultimately decided by the Inter-Ministeral Pricing Comission (Comisión Interministerial de Precios de los Medicamentos - CIPM).

Companies can submit as much documentation as they wish to support a case for reimbursement. As part of these documents it is mandatory for the company to establish the desired price, as well as:

- Cost per day (compared to equivalent products in Spain)

- Price of product in other EU countries (if it’s implemented somewhere else)

- Sales forecast

- Overall cost of Research & Development, production cost, etc

All the relevant documentation is then analysed by the CIPM. This commission contains officials from the Ministry of Health, the Ministry of Economy and Finance, and the Ministry of Industry, Tourism and Trade, as well as two regional representatives from each Spanish region. CIPM are responsible for setting market prices.

Once the product gets included in the national reimbursement list, it is valid throughout the country and the product prices are published in an Official Journal (Boletín Oficial del Estado).

The criteria used to decide this, and the exact pricing, includes:

- Severity, duration and sequels of the diseases

- Utility of the drug

- Rationalization of public drug expenditures

- Alternatives to the drug

- The innovation of the drug

If there’s an approved reimbursement, the pricing is decided according to those categories.

If the reimbursement is denied, it will be added to a “negative list” and the price will be determined by the manufacturer – a process known as “free pricing”. Spanish autonomous regions have the freedom to negotiate with the medical companies to establish their own pricing on non-reimbursed products/devices.

According to the law the whole reimbursement process should not take longer than 180 days. However, it usually takes longer for Spanish authorities to reach a decision.

Figure 1 - Approval and Reimbursement Process

Find out more on how to price your medical device by downloading our free guide now.