Switzerland (Head Quarters)

IDR Medical Switzerland

Austrasse 95, CH-4051 Basel, Switzerland

T:

+41 (0) 61 535 1109

UK

IDR Medical UK

Unit 104 Eagle Tower, Eagle Tower

Montpellier Drive, Cheltenham, GL50 1TA

T:

+44 (0) 1242 696 790

USA

IDR Medical North America

225 Franklin Street, 26th Floor

Boston, Massachusetts 02110, USA

T:

+1 (0) 617.275.4465

The Reimbursement Environment for Medical Devices in Germany

Background

Germany has a stable healthcare system, rooted in compulsory contributions to Statutory Health Insurance (Gesetzliche Krankenversicherung/GKV). Approximately 92% of the population is covered by it, and it aims to provide a fair benefit package to the nation.

Individuals can leave this scheme in favour of private insurance (PKV), provided they reach a specific threshold of income.

Both public and private insurance are anchored in statutory regulations, and manufacturers looking to introduce a new medical device will meet rigorous approval processes.

Who are the Decision Makers/Influencers?

The Federal Joint Committee/Der Gemeinsame Bundesausschuss (GBA) is the highest decision-making body in the Healthcare System. Issuing directives for the benefit catalogues of the SHI.

- The Ambulatory Care Committee (part of the GBA); maintain the catalogue for ambulatory devices: EBM (Uniform Evaluative Standard)

Other important stakeholders:

- DIMDI (German Institute of Medical Documentation and Information); define the G-DRG inpatient catalogue (Germany Diagnosis Related Groups), & the EBM

- InEK (Institute for the Hospital Remuneration System); responsible for maintenance/update of G-DRG codes

- GKV-SV (Gesetzliche Krankenversicherung Spitzenverband) work with SHI to define compensation packages awarded to districts

Reimbursement and Pricing Approval Process

Inpatient

Initial purchase of medical devices are covered by federal funding. These contracts are unique to, and negotiated by, each hospital.

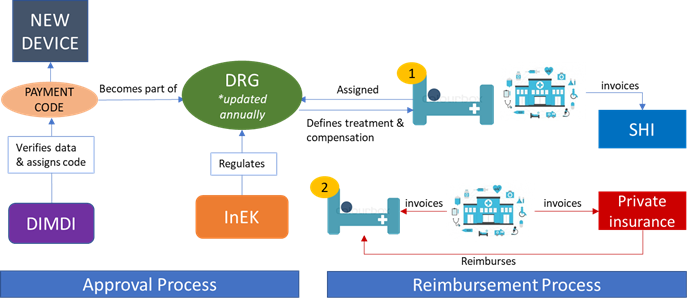

All CE (Conformité Européenne certified) medical devices are assigned a payment code which is defined by the DIMDI, and codes are regulated by the InEK.

These payment codes collectively form the G-DRG. The DIMDI and InEK update the list annually, based upon empirical data from ~2 years previous. Each patient is assigned to one DRG that defines the compensation they are awarded. These rules relate to diagnosis and any associated procedures. Compensation is billed on a ‘fee per case’ basis, which covers the device’s labour, disposable and running costs. In the case of private insurance, patients can pay upfront and claim it back from their insurer.

Hospitals are not allowed to increase their spending beyond these defined limits. As the budget has remained relatively stable throughout the past few years the introduction of new devices is difficult. Hospitals will either need to enquire for an increase in this budget or rearrange patient activity to allow for new space.

Figure 1; Approval/reimbursement for inpatient care

Outpatient

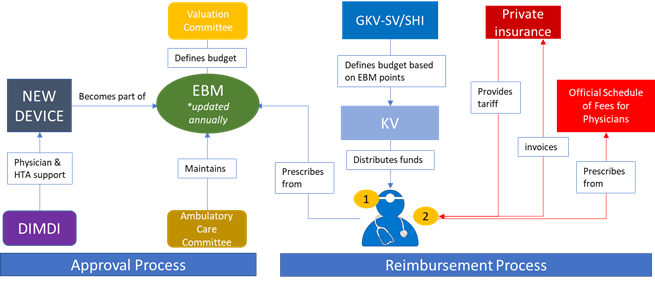

Similarly to the DRG, medical devices in this sector must be listed in a catalogue of auxiliary devices: The EBM. The DIMDI determine the products in this category. Devices listed on the EBM reflect physician support and suggest a Health Technology Assessment (HTA) was done. The Ambulatory Care Committee maintain the catalogue, and update it annually based upon empirical data from ~2 years previous. The Valuation Committee defines the price or ‘points’ of EBM products.

The reimbursement process in this environment is more complex. Medical practices receive funds from their Regional Association of Statutory Health Insurance Physicians (GKV-SV) per quarter. There are 17 regional KVs (Office physician association, Kassenärztliche Vereinigung) in Germany that are responsible for ensuring a sufficient level of care. The KVs work with the SHI to decide upon the compensation package awarded to each respective district. This package pools all funds designed to cover medical services in the region and is distributed by the KV to the doctors based upon predetermined agreements.

This sector is subject to a budget in the same way as the inpatient sector, however funds are limited. If a physician exceeds the EBM points assigned, they aren’t reimbursed. Moreover, this approach is based upon a fee-for-service and a patient’s diagnosis has no bearing on the system.

Private insurers don’t use the EBM. Instead, comparable regulations are specified in the ‘Official Schedule of Fees for Physicians’. The insurer will either be billed or provide a default tariff prior to treatment.

Figure 2; Approval/reimbursement for outpatient care

The Future

New medical devices are difficult to introduce due to the strict approval processes. Devices must be listed on the EBM and G-DRG to be prescribed, and these catalogues are based on old empirical data. This time lag hampers a new device’s use in the market.

Solutions:

Inpatient

- NUB (New methods of treatment and screening): Deals with innovative treatments that are not yet assigned as DRG. Individual hospitals can apply for additional funds once a year. The InEK oversee the approval of applications. However, success rate is very low.

- Hospitals can alternatively add an additional invoice, and these applications aren’t limited to innovative devices/treatments. Success is relatively higher.

Outpatient

- Alternatively, The Federal Joint Committee can aid the fast track of a new device’s use. By supplementing funding for a controlled study, the manufacturer could reach the threshold required for devices to theoretically be introduced to the EBM. If the aforementioned threshold is met, an application for reimbursement can be made.