Switzerland (Head Quarters)

IDR Medical Switzerland

Austrasse 95, CH-4051 Basel, Switzerland

T:

+41 (0) 61 535 1109

UK

IDR Medical UK

Unit 104 Eagle Tower, Eagle Tower

Montpellier Drive, Cheltenham, GL50 1TA

T:

+44 (0) 1242 696 790

USA

IDR Medical North America

225 Franklin Street, 26th Floor

Boston, Massachusetts 02110, USA

T:

+1 (0) 617.275.4465

The Reimbursement Environment for Medical Devices in Italy

Background

Italy has a population of 60.6 million citizens (2017) that reside in 20 regions.

Healthcare coverage is provided by the Servizio Sanitario Nazionale (SSN, or National Health Service), financed through a combination of public and private provision. The Ministry of Health is responsible for overlooking the SSN – and is decentralized into three levels:

- National Level – Ministry of Health sets a 3-year plan (Piano Sanitario Nazionale - PSN) to determine general country wide healthcare policies.

- Regional Level – Regions implement the PSN with personal resources, adjusting to local needs and policies.

- Local Level – Local health units known as ASL/ATS (Azienda Sanitaria Locale or Agenzia di Tutela della Salute) are the providers of healthcare services (Primary/specialist care and non-emergency admissions). Locally, Aziende Ospedaliere (AO) or Aziende Socio Sanitarie Territoriali (ASST) and IRCCS (Istituti di Ricerca e Cura a Carattere Scientifico) are large teaching and research hospitals.

Funding comes from the SSN through per capita budgets determined in the PSN, that are transferred to the regional offices and ultimately to the ASL/ATS. Worth noting is that per-capita budgets vary based on regional resources and are adjusted to local needs and policies. Therefore, healthcare access and co-payments can vary geographically.

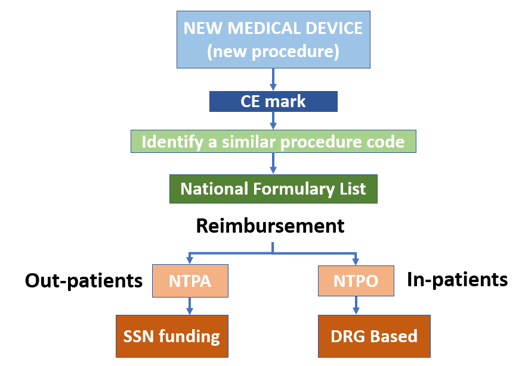

Remuneration occurs via ‘fee-for service’ taken from the National Formulary List, of which there are two main ones: NTPA (Nomenclature Tariffario delle Prestazioni Ambulatoriali) that is the list of out-patient procedures that are covered through SSN funding and NTPO (Nomenclatore Tariffario delle Prestazioni Ospedaliere) the DRG in-patient list that covers the entirety of hospital activity.

Who are the decision makers/influencers?

There are three national bodies that are responsible for overlooking medical products in the Italian healthcare system, each have varying degrees of responsibility:

- Ministry of Health/Direttorato Generale Farmaci e Dispositivi Medici (DGFDM, or General Directorate of Medicines and Medical Devices) The main duties of this department are to develop and monitor quality assurance systems, to coordinate health policies with the government, but most importantly to authorize and control medicines, medical devices and any other health products

- Commisione Unica Dispositivi Medici (CUD, or Commission for Medical Devices) The CUD has the role of collaborating with the Ministry of Health and the DGFDM as a consultant, to highlight any issues medical devices may present. It is also involved in comparing the costs of medical devices, to then determine what the most appropriate options are for regional budgeting.

- Agenzia Nazionale per i Servizi Sanitari Regionali (AGENAS, or National Agency for Regional Healthcare Services) Tasked to identify innovation and quality opportunities in healthcare and to improve cost effectiveness of services provided to patients.

Reimbursement and pricing approval process

Manufacturers wanting to introduce new medical devices in the Italian market will not be able to negotiate price and reimbursement options with the Ministry of Health. Instead, funding is sought at the regional or local level. Three regional bodies will influence this process:

- Agenzie Sanitarie Regionali (or Regional Health Agencies) Responsible for monitoring healthcare purchasing for their respective regions and evaluating performance. These agencies are also concerned with implementing national health initiatives at the regional level whilst regulating budgets.

- Commissioni Regionali Dispositivi Medici (or Regional Committees for Medical Devices) Regions and health providers can collaborate to set up committees to evaluate medical devices and assess their use in practice

- Commissione Prontuario Terapeutico Ospedaliero (CPTO, or Commission for the Hospital Therapeutic Handbook) While CPTO’s are usually involved with monitoring drug usage in hospitals, some also monitor medical device usage. This can change by region, but some of these committees have a significant influence on device purchasing.

For a medical device to be considered safe to use in Italy, it must hold a CE mark. However, being able to market a medical device does not mean the national health service will reimburse it. In fact, new medical devices do not seem to follow a particularly structured reimbursement path, depending much more on provider decisions and local health systems purchasing capabilities.

These points highlight steps that could increase the acceptance and reimbursement of new medical devices:

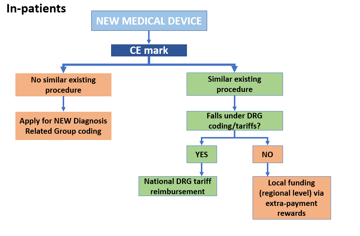

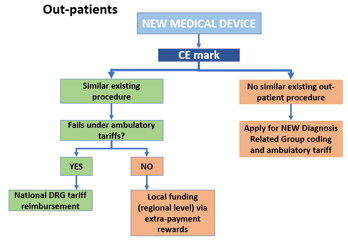

- Associating a new medical device to an already established diagnosis/procedural DRG code. Being able to associate a new medical device to an established diagnosis/procedural code would allow it to be listed with already used devices in the National Formulary List where they are covered by the Servizio Sanitario Nazionale. CPTO’s are responsible to assess if the device should be enlisted in the formulary and decides to purchase. ASL’s and Hospitals are now grouping in Commissioni Terapeutiche di Area Vasta (CTAV) to procure better prics for products.

- If the medical device is part of a procedure that exists already its adoption will be determined by the price.

- As different regions have different degrees of funding, cost effective devices with an existing DRG code would be adopted rapidly and reimbursed quickly.

- More innovative/expensive devices may not be included in diagnosis related group funding and will require separate reimbursement from regional budgets. Once again, it is important to note that each region will have a different funding environment and evaluation process for new technologies.

The future

A recent trend in the Italian reimbursement environment involves the establishment of nationwide health technology assessment agencies. Italy’s regional division had led to the rise of regional committees appointed with the responsibility of evaluating medical devices. A consequence of this division was the fragmentation of patient care and technology across the country.

The European Union’s directive 2011/24 (Cooperation on Health Technology Assessment) will now require member countries to create national HTA (Health Technology Assessment) models led by the government to evaluate and promote cost-effective medical devices. This will be of significant impact to Italy as nationwide systems will be implemented to standardize the selection of medical devices to be used across hospitals. Pushing for collaboration amongst different regions will ensure the most valuable devices, both for costs and innovation, are evaluated and adopted across the country. This might also see specific reimbursement criteria being defined for new devices, a much-needed change to the current system.