Switzerland (Head Quarters)

IDR Medical Switzerland

Austrasse 95, CH-4051 Basel, Switzerland

T:

+41 (0) 61 535 1109

UK

IDR Medical UK

Unit 104 Eagle Tower, Eagle Tower

Montpellier Drive, Cheltenham, GL50 1TA

T:

+44 (0) 1242 696 790

USA

IDR Medical North America

225 Franklin Street, 26th Floor

Boston, Massachusetts 02110, USA

T:

+1 (0) 617.275.4465

The Reimbursement Environment For Medical Devices In the UK

The NHS was rated as the world’s best healthcare system in 2017 and stands out as a top performer in most categories. However, as the UK population continues to increase to a projected 71.04 million by 2030 and as the average age is expected to rise to 42.8 by 2037, the NHS is being put under serious strain and faces severe funding challenges - which will of course have a direct impact on medical device pricing and reimbursement.

The UK has one of the largest medical device markets in the world and is the third largest in Europe behind Germany and France, however introducing new technologies and devices to the NHS has always been challenging. In order to fully understand the UK reimbursement market, you need to identify the main decision makers and get to grips with the typical path to national (NHS) or local (CCG) reimbursement. Read on to find out more…

Background

The UK’s healthcare system is single payer and is primarily public, with 80% of the funding coming from taxation. As a public health system, the NHS provides public healthcare to all of its permanent residents which is free at the point of need.

Clinical Commissioning Groups (CCGs) are responsible for providing NHS healthcare services to local populations, having taken over from Primary Care Trusts in 2013. There are currently 207 CCGs in England supported by Clinical Commissioning Units, and CCGs are responsible for approximately ⅔ of the total NHS England budget - or £73.6 billion in 2017/18.

CCGs are groups of general practices which come together in each area to commission the best services for their population and provide a range of community health services including funding for GPs and the commissioning of hospital and mental health services. As a result they are considered to be key stakeholders in healthcare decision making and actually manage most of the NHS commissioning budget.

Who are the decision makers/influencers?

Value for money at the national level is commonly assessed through a process of Health Technology Assessment (HTA), with each country within the UK having its own approach. The National Institute for Health and Clinical Excellence (NICE) and the National Coordinating Centre for Health Technology Assessment (NCCHTA) are the key national HTA organisations for England, Wales and Northern Ireland.

NICE is the most important organisation to introduce new technologies in the UK health system, but there is often confusion surrounding what it does, its guidance and what it means. In a nutshell, NICE conducts appraisals and develops guidelines whereas the NCCHTA manages and develops the NHS HTA programme.

NICE is an independent organisation established to produce national guidance on specific health technology including both medicines and medical devices as well as clinical practice. It runs many different programmes and looks at medical devices in many ways, from safety to efficacy through to patient, system and economic benefit.

NICE guidance helps the NHS to adopt effective and cost-efficient technologies and procedures and is highly influential across the world. It thoroughly reviews evidence and incorporates advice and input from experts, patients and caregivers, and does so nationally for local health authorities, local government, charities and anyone with a responsibility for commissioning or providing health and social care.

Reimbursement and pricing approval process

Approval

After receiving a CE mark a new medical device is reviewed by NICE. This organization appraises the interventions that impact health benefits, government policies and NHS resources to then issue national guidance for care.

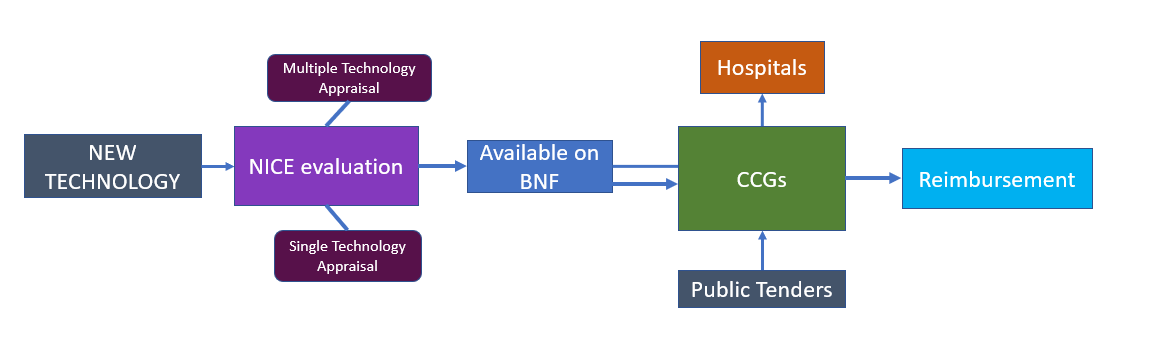

New technologies are appraised by NICE through two routes: through Multiple Technology Appraisals (MTAs) that examine a disease area of class of drugs and contain new evidence gathered after the launch of a drug or include economic modelling, or Single Technology Appraisals (STAs) that provide early guidance on new drugs targeting a single indication. New technologies are appraised by NICE through one of three routes:

- Multiple Technology Appraisals (MTAs) usually covers more than one technology, or a single technology to be used in more than one indication

- Single Technology Appraisal (STAs) forms cover a single technology to be used in a single indication

- Fast Track Approval (FTA) this form covers a single technology used in a single indication, however it is typically for shorter process time so that it can speed access to novel cost-effective treatments

Reimbursement

CCGs are clinically led statutory NHS bodies whose task is to plan and commission healthcare services in their local area. Collectively, they are responsible for approximately 2/3 of the NHS budget and influence the prescription and reimbursement of medical devices often aided by regional competitive tenders. In summary, if a product is listed in the BNF and is available at the CCG level it can be fully reimbursed, this is more likely to be the case if it is an equivalent product.

The publicly funded NHS reimbursement system doesn’t reward clinicians financially for performing a procedure and there are no specific product related codes either. Instead, clinicians are simply paid an annual salary. This means that unlike other markets and different countries, you don’t need to negotiate with hundreds of insurance companies; it is the CCGs’ responsibility to pay hospitals for performing procedures, which is why they are now often referred to as payers.

The NHS reimbursement system works according to the following:

- The diagnosis of the patient by ICD code

- The procedure/procedures performed by OPCS code

- Length of stay and type of admission

- The location of the hospital

All of the information is input into a computer system called a grouper, resulting in a HRG or DRG code which has a financial value or tariff. The hospital then claims the amount for the procedure from the CCG every month by a payment system called SUS.

Other factors that make a difference to what the hospital is paid for performing a procedure include emergency admissions which are often paid higher and specialist service top ups such a paediatric procedures which have a significant top up. There are also rewards in place to financially drive day case treatments over longer stays to reward productivity known as Best Practice Tariff (BPT).

Overall, the NHS reimbursement system is quite complicated and also flawed; it rewards activity but not necessarily results.

The future

In 2016 NHS England introduced a new nationwide system for purchasing expensive medical devices and implants used in specialised services. With wide variations in the prices hospital trusts pay for the same products - some varying by over 50% - as well as in the rates of adoption and usage of devices across the country, NHS England decided to take a more rigorous commercial approach and reduce price variations to save millions of pounds from the annual cost of devices. The new approach also aims to improve access for patients to new technologies by enabling devices to be adopted quickly, easily and at the best price.

The new system expects to see savings of over £60 million reinvested into specialist care. Operated by the NHS Supply Chain, it involves zero cost to healthcare providers and rather than separate hospital trusts paying for the devices and being reimbursed by NHS England, providers will now place orders for these devices with the NHS Supply Chain at no additional cost. NHS Supply Chain will then place the order with the suppliers and invoice NHS England directly.

If you have any further questions on UK reimbursement, or where to start with your medical device pricing strategy, download our guide here:

Request a free consultation here